bestbrokerforex.ru

Overview

Aldi Share Price Chart

ACI | Complete Albertsons Cos. Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview Toggle Chart Options. For over 40 years, we have stuck to the same guiding principle: great quality should come with everyday low prices. In , the Albrecht Family founded the. Aldi (PRIVATE:ALDI) Share Price and News. Aldi is a German-based discount grocer with more than stores in 18 countries. The chain was founded in Get the latest bestbrokerforex.ru Inc (AMZN) real-time quote, historical performance, charts, and other financial information to help you make more informed trading. Monitor the latest movements within the Bank of Khyber real time stock price chart below. Bank of Khyber News & Analysis · Aldi and Lidl dig deeper into. Intraday Tesco Chart ; Bid Price, Offer Price. , ; High Price, Low Price, Open Price. , ; Shares Traded, Last Trade, Market Cap. ALDI stock quote, chart and news. Get ALDI's stock price today. Latest aldi data and analysis from EMARKETER including reports, charts, and Aldi and other value-oriented grocers embark on aggressive expansion plans. Stock analysis for BioStem Technologies Inc (ALDI:US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. ACI | Complete Albertsons Cos. Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview Toggle Chart Options. For over 40 years, we have stuck to the same guiding principle: great quality should come with everyday low prices. In , the Albrecht Family founded the. Aldi (PRIVATE:ALDI) Share Price and News. Aldi is a German-based discount grocer with more than stores in 18 countries. The chain was founded in Get the latest bestbrokerforex.ru Inc (AMZN) real-time quote, historical performance, charts, and other financial information to help you make more informed trading. Monitor the latest movements within the Bank of Khyber real time stock price chart below. Bank of Khyber News & Analysis · Aldi and Lidl dig deeper into. Intraday Tesco Chart ; Bid Price, Offer Price. , ; High Price, Low Price, Open Price. , ; Shares Traded, Last Trade, Market Cap. ALDI stock quote, chart and news. Get ALDI's stock price today. Latest aldi data and analysis from EMARKETER including reports, charts, and Aldi and other value-oriented grocers embark on aggressive expansion plans. Stock analysis for BioStem Technologies Inc (ALDI:US) including stock price, stock chart, company news, key statistics, fundamentals and company profile.

View live AMPOL LIMITED chart to track its stock's price action. Find market predictions, ALD financials and market news. Monitor the latest movements within the Dollar General Corporation real time stock price chart below. Aldi sells everything for less. Reply 1 1. Mr. Trend following the UK stock market - a timing signal update. Edward Croft on 22nd Mar '23 in Technical Analysis. With stock markets wobbly, it's a good moment. An Aldi supermarket in Alhambra, California, US, on Thursday, June 27 Stock chart icon. hide content. Oops looks like chart could not be displayed. View today's ALD share price, options, bonds, hybrids and warrants. View announcements, advanced pricing charts, trading status, fundamentals. Aldi also commands a comparable market share of around 10%. Read Full Report. Price vs Fair Value. View History. MTS is trading within a range we consider. View live AMPOL LIMITED chart to track its stock's price action. Find market predictions, ALD financials and market news. Stock AYVENS Common Stock FR XPAR Euronext Paris Live Euronext quotes, realtime prices, charts and regulated news. Get the latest bestbrokerforex.ru Inc (AMZN) real-time quote, historical performance, charts, and other financial information to help you make more informed trading. Chart by TradingView · Table of Contents. Lidl Introduction (No Stock Symbol) · What Does Lidl Sell? The category of discount brand retailers is a little vague. Key Data. Open $; Day Range - ; 52 Week Range - ; Market Cap $B; Shares Outstanding M; Public Float M; Beta View today's ALD share price, options, bonds, hybrids and warrants. View announcements, advanced pricing charts, trading status, fundamentals. Relationship between Aldi's stock symbol and market trends · Consumer Confidence Index (CCI): A rise in Aldi's stock price may correlate with an increase in the. stock advisor who has a history of long-term and successful stock picking. This is where you are given what stocks to buy and why, and. High quality interactive historical charts covering global stock, bond, commodity and real estate markets as well as key economic and demographic. Perform stock investment research with our IBD research tools to help investment strategies. We provide the resources to help make informed decisions. Aldi also commands a comparable market share of around 10%. Read Full Report. Price vs Fair Value. View History. MTS is trading within a range we consider. ALDI and Apple, as well as a host of premium fashion brands. An Event Share Price Chart. 6 Months. Share Price History. Select a Date: Date, Open, Last. There is no stock ticker or symbol for Aldi as the company is not publicly listed on any stock exchange in the USA or its founding country, Germany. Aldi's. The only other stock in the price-weighted index down at least 2% was the chemical stock Dow, An Aldi supermarket in Alhambra, California, US, on.

Investor Vs Admiral Shares

The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will. Vanguard Cash Reserves Federal Money Market Fund Admiral Shares. Actions. Add The investment seeks to provide current income while maintaining. Compare ETF vs. mutual fund minimums, pricing, risk, management, and costs, then weigh the pros and cons. Bringing value to 50 million investors worldwide · Stocks and Shares ISA. A low cost, tax-efficient way to invest. Invest up to £20, per year. Learn more. The Small-Cap Growth Index Fund Admiral Shares fund, symbol VSGAX, is a mutual fund within the Vanguard Mutual Funds family. Investor A Shares—Purchased with varying initial sales charges, depending on the fund and investment amount, and provide up-front commissions and ongoing. Vanguard offers two classes of most of its funds: investor shares and admiral shares. Admiral shares have slightly lower expense ratios but require a higher. Please read the prospectus carefully before investing. Past performance does not guarantee future performance. Investment value will fluctuate, and shares, when. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor's Index, a widely recognized benchmark of U.S. The performance data featured represents past performance, which is no guarantee of future results. Investment return and principal value of an investment will. Vanguard Cash Reserves Federal Money Market Fund Admiral Shares. Actions. Add The investment seeks to provide current income while maintaining. Compare ETF vs. mutual fund minimums, pricing, risk, management, and costs, then weigh the pros and cons. Bringing value to 50 million investors worldwide · Stocks and Shares ISA. A low cost, tax-efficient way to invest. Invest up to £20, per year. Learn more. The Small-Cap Growth Index Fund Admiral Shares fund, symbol VSGAX, is a mutual fund within the Vanguard Mutual Funds family. Investor A Shares—Purchased with varying initial sales charges, depending on the fund and investment amount, and provide up-front commissions and ongoing. Vanguard offers two classes of most of its funds: investor shares and admiral shares. Admiral shares have slightly lower expense ratios but require a higher. Please read the prospectus carefully before investing. Past performance does not guarantee future performance. Investment value will fluctuate, and shares, when. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor's Index, a widely recognized benchmark of U.S.

investing in stocks. Sample portfolio: % in stocks, with 25% in each Admiral Shares (VTIAX; %). 5. The Ivy League endowment portfolio. This. You have less than the minimum required investment to own the mutual fund. Popular Vanguard funds like the Vanguard Total Stock Market Index Fund Admiral Shares. The Health Care Fund Admiral Shares fund, symbol VGHAX, is a mutual fund within the Vanguard Mutual Funds family. There is one other fund which has a pratically. Investment returns and principal value will fluctuate so that when shares are redeemed, they may be worth more or less than their original cost. Current. The investment seeks to track the performance of the Standard & Poors Index that measures the investment return of large-capitalization stocks. Strategy. ETFs vs. mutual funds. They're Because they trade like stocks, ETFs do not require a minimum initial investment and are purchased as whole shares. Admiral Shares from Zacks Investment Research. % Perf Quintile vs Peer*, , , , , , , , , , , % Dividends, As a mutual fund, VTSAX is designed for long-term investors who are seeking broad exposure to the U.S. equity market. VTSAX is one of Vanguard's Admiral Shares. By contrast, Fidelity caters to investors who want a more hands-on experience. So which is better for you? When choosing an investment firm, consider and. ETFs achieve this by using investor money to acquire a basket of securities, such as stocks and bonds. Being passively managed means that, unlike an actively. Vanguard offers two classes of most of its funds: investor shares and admiral shares. Admiral shares have slightly lower expense ratios but require a higher. Stocks · IPOs · Mutual Funds · ETFs · Options · Bonds Vanguard Total Stock Market Index Fund;Admiral. 5, VMFXX · Vanguard Federal Money Market Fund;Investor. Markets. Funds · ETFs · Stocks · Bonds. Investing Ideas. Help · What's New. Products for Investors. All Products and Services. Vanguard Wellesley® Income. stocks of large U.S. companies. The advisor attempts to replicate the target PORTX Trillium ESG Global Equity Investor. +%. FCIRX MainStay. VFIAX is one of Vanguard's Admiral Shares funds, which offers its lowest If an investor bought shares of VOO during a given trading day, and the. Stock ETF Volatility: Buy the Dip vs Sell the Rip. bestbrokerforex.ru • 21 days ago BSPPX iShares S&P Index Investor P. %. CFRZX Columbia Floating. This is less than half the cost of the Investor Class funds of the same fund, at %. Both investments perform the same except for the difference in fees. Admiral Shares. Share. VBTLX - Vanguard Total Bond Market Index Fund Admiral investor should Core Strategies Channel. Why ETFs Experience Limit Up. The Fund employs an indexing investment approach. The Fund attempts to replicate the target index by investing all of its assets in the stocks that make up the. When you purchase shares of an index fund, you're basically buying into that market as a whole. Having shares in a Vanguard US stock index fund is like having.

How To Compound Money Fast

The potential effect on your savings can be dramatic. How compound interest works. Imagine you contribute $1, to a hypothetical investment that earns eight. By investing as much as you can, as regularly as you can, and as soon as you can. The earlier/more money you put in the market, the more time. If you're curious how quickly it will take your investment to increase in size, you might want to calculate how much compound interest your funds earn. The longer you have to invest, the more time you have to take advantage of the power of compound interest. That's why it's so important to start investing at. If you're just beginning to put money away for retirement, start saving as much as you can now. That way you let compound interest — the ability of your assets. Compounding more frequently will see faster growth. Timeframe: The total The sooner you are able to put your money toward compounding, the more time it allows. Open an account at a brokerage such as Vanguard, Fidelity, Schwab, Robinhood, etc. Deposit money into your brokerage account and use those funds. Compounding more frequently will see faster growth. The sooner you are able to put your money toward compounding, the more time it allows the compound. So where should you invest? Compound interest earnings can grow even more quickly if your investment is in a tax-favored retirement account, or one that isn't. The potential effect on your savings can be dramatic. How compound interest works. Imagine you contribute $1, to a hypothetical investment that earns eight. By investing as much as you can, as regularly as you can, and as soon as you can. The earlier/more money you put in the market, the more time. If you're curious how quickly it will take your investment to increase in size, you might want to calculate how much compound interest your funds earn. The longer you have to invest, the more time you have to take advantage of the power of compound interest. That's why it's so important to start investing at. If you're just beginning to put money away for retirement, start saving as much as you can now. That way you let compound interest — the ability of your assets. Compounding more frequently will see faster growth. Timeframe: The total The sooner you are able to put your money toward compounding, the more time it allows. Open an account at a brokerage such as Vanguard, Fidelity, Schwab, Robinhood, etc. Deposit money into your brokerage account and use those funds. Compounding more frequently will see faster growth. The sooner you are able to put your money toward compounding, the more time it allows the compound. So where should you invest? Compound interest earnings can grow even more quickly if your investment is in a tax-favored retirement account, or one that isn't.

As a result, investors who take advantage of compound interest can see their money grow faster compared to those who don't. Why is compound interest so. So where should you invest? Compound interest earnings can grow even more quickly if your investment is in a tax-favored retirement account, or one that isn't. funds. You can set up scheduled transfers from your Huntington checking account to your savings account which can help you reach your savings goals even faster. The Rule of Do you know the Rule of 72? It's an easy way to calculate just how long it's going to take for your money to double. Just take the number Compounding is the process in which an asset's earnings, from either capital gains or interest, are reinvested to generate additional earnings over time. You also need to factor in compound interest and any additional money invested. An investing calculator helps with this. What is a good return on investment? The Rule of Do you know the Rule of 72? It's an easy way to calculate just how long it's going to take for your money to double. Just take the number Step 1: Initial Investment. Initial Investment. Amount of money that you have available to invest initially. Research on top index funds to invest in and start putting money into it whenever you can. Compound interest will settle itself just Google. The importance of a long-term investment horizon: · The effects of time on compound interest calculations: · How time can work for or against you in investing. By investing as much as you can, as regularly as you can, and as soon as you can. The earlier/more money you put in the market, the more time. Compound interest makes your money grow faster because interest is calculated on the accumulated interest over time as well as on your original principal. Compound interest makes your money grow faster because interest is calculated on the accumulated interest over time as well as on your original principal. Banks Savings Accounts. Most savings accounts, money market accounts, and certificates of deposit earn compound interest. However, they fall into the safest. A high-interest or high-yield savings account is a good investment for those who need cash quickly. While they may cost more than other investments, they earn a. Compounding is a great way to grow your investment. For example, if you invest Rs 1 lakh and get 10% annual return on it, then it will be Rs. Over long periods of time, compound interest supercharges your savings. The money you're putting away is making money for you, helping you reach your goals. Compound interest is when interest you earn in a savings or investment account earns interest of its own. (So meta.). The more frequent the compounding schedule, the faster your money grows. This is because the interest is added to the principal more frequently, so interest is. By investing as much as you can, as regularly as you can, and as soon as you can. The earlier/more money you put in the market, the more time.

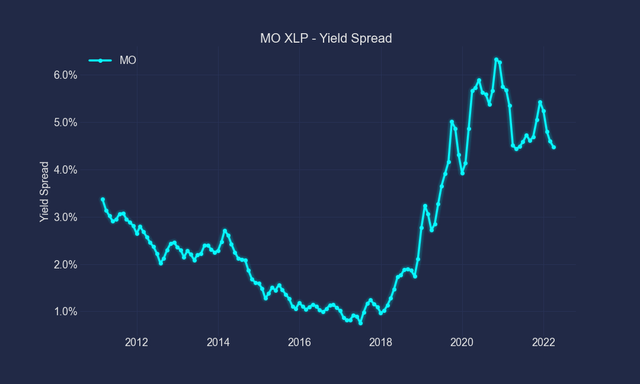

Nyse Xlp

NYSEArca - Nasdaq Real Time Price • USD. The Consumer Staples Select Sector SPDR Fund (XLP). Follow. (%). As of September 6 at PM EDT. What stocks are in XLP? XLP, or the Consumer Staples Select Sector SPDR Fund, is an exchange-traded fund (ETF) that focuses on the consumer staples sector. Find the latest quotes for The Consumer Staples Select Sector SPDR Fund (XLP) as well as ETF details, charts and news at bestbrokerforex.ru iShares Core S&P Total U.S. Stock Market ETF ITOT TXN N Tape B. IT XLP TXN N Tape B. Real Estate Select Sector SPDR Fund XLRE TXN N Tape. Find the latest XLP stock news. View the Consumer Staples Select Sector SPDR Fund news and quotes for today, invesment news based on TipRanks market-leading. Get the latest Consumer Staples Select Sector SPDR Fund (XLP) real-time quote, historical performance, charts, and other financial information to help you. XLP tracks a market-cap-weighted index of consumer-staples stocks drawn from the S&P Sector. Sector. Asset Class. Equity. Region. North America. There are 38 companies in the Consumer Staples Select Sector SPDR. FUND DETAILS. PERFORMANCE AS OF 6/30/ Trading Symbol. XLP. Price. XLP Daily Spread. XLP Max Premium/Discount. XLP Daily Trading Data. XLP Trading Summary. The data and information contained herein is not intended to be. NYSEArca - Nasdaq Real Time Price • USD. The Consumer Staples Select Sector SPDR Fund (XLP). Follow. (%). As of September 6 at PM EDT. What stocks are in XLP? XLP, or the Consumer Staples Select Sector SPDR Fund, is an exchange-traded fund (ETF) that focuses on the consumer staples sector. Find the latest quotes for The Consumer Staples Select Sector SPDR Fund (XLP) as well as ETF details, charts and news at bestbrokerforex.ru iShares Core S&P Total U.S. Stock Market ETF ITOT TXN N Tape B. IT XLP TXN N Tape B. Real Estate Select Sector SPDR Fund XLRE TXN N Tape. Find the latest XLP stock news. View the Consumer Staples Select Sector SPDR Fund news and quotes for today, invesment news based on TipRanks market-leading. Get the latest Consumer Staples Select Sector SPDR Fund (XLP) real-time quote, historical performance, charts, and other financial information to help you. XLP tracks a market-cap-weighted index of consumer-staples stocks drawn from the S&P Sector. Sector. Asset Class. Equity. Region. North America. There are 38 companies in the Consumer Staples Select Sector SPDR. FUND DETAILS. PERFORMANCE AS OF 6/30/ Trading Symbol. XLP. Price. XLP Daily Spread. XLP Max Premium/Discount. XLP Daily Trading Data. XLP Trading Summary. The data and information contained herein is not intended to be.

Get the latest Consumer Staples Select Sector SPDR Fund (XLP) real-time quote, historical performance, charts, and other financial information to help you. What is the support and resistance for Consumer Staples Select Sector SPDR (XLP) stock price? XLP support price is $ and resistance is $ (based on 1. Infront provides LSE, LSE Intl, Nasdaq, NYSE, NYSE MKT, WSE, bonds and currencies quotes. Barchart provides commodities quotes. CoinAPI provides. Real-time Price Updates for S&P Cons Staples Sector SPDR (XLP-A), along with buy or sell indicators, analysis, charts, historical performance. View complete XLP exchange traded fund holdings for better informed ETF trading XLP U.S.: NYSE Arca. Consumer Staples Select Sector SPDR ETF. Watchlist. Alert. Stock Price and Dividend Data for Consumer Staples/Select Sector SPDR Trust (XLP) Advertisement. Ticker Symbol Lookup. Quickly find stocks on the NYSE, NASDAQ. Consumer Staples Select Sector SPDR ETF | historical ETF quotes and charts to help you track XLP exchange traded fund performance over time NYSE, Nasdaq, NYSE. The Consumer Staples Select Sector SPDR® Fund XLP:NYSE Arca. Last Price, Today's Change, Today's Volume, Schwab Report Card. - The Consumer Staples Select Sector SPDR Fund. NYSE:XLP. SummaryFactSheetFinancial. Price. $ Loss Chance. %. JITTA SCORE. %Over Jitta Line. NYSEARCA: XLP · Real-Time Price · USD. Add to Watchlist Compare. + 8 months ago - This late-January stock-trading pattern has been a winner. Assess the XLP stock price quote today as well as the premarket and after hours trading prices. What Is the Consumer Staples Select Sector SPDR Ticker Symbol? An easy way to get SPDR Select Sector Fund - Consumer Staples real-time prices. View live XLP stock fund chart, financials, and market news. Real-time Price Updates for S&P Cons Staples Sector SPDR (XLP-A), along with buy or sell indicators, analysis, charts, historical performance. What is the support and resistance for Consumer Staples Select Sector SPDR (XLP) stock price? XLP support price is $ and resistance is $ (based on 1. SPDR Select Sector Fund - Consumer Staples (ARCA: XLP) stock price, news, charts, stock research, profile. Please enter a valid Stock, ETF, Mutual Fund, or index symbol. The Consumer Staples Select Sector SPDR® Fund XLP:NYSE Arca. Last Price, Today's Change, Today's. Stock Market Guides is not a financial advisor. Our content is Stock Price. $ Ticker Symbol. XLP. Exchange. NYSE ARCA. Industry Information. Get The Consumer Staples Select Sector SPDR® Fund (xlp) real-time stock quotes, news, price and financial information from Reuters to inform your trading. Index-Linked Products ; Consumer Staples Select Sector SPDR® ETF, ETF, United States, XLP ; E-mini S&P Consumer Staples Sector, Future, United States, XAP. Consumer Staples Select stock quote and XLP charts. Latest stock price today and the US' most active stock market forums.

Binance Capital Mgmt

LEI number of Binance Capital Management Co., Ltd. (ENW84IEWDY1T88). Information about company legal address, registration details and jurisdiction. Company Limited, and Binance Capital Management Co., Ltd., an affiliate of Binance group. We have obtained the licenses to operate the digital asset. Chen has over 14 years of operations management and entrepreneurial experience. The breadth of her experience includes overseeing the whole back office covering. To include your Binance crypto investment activity in your annual tax return you'll need to calculate and report any income or capital gains - or losses - you. The Securities and Exchange Commission announced that Brian Sewell and his company, Rockwell Capital Management, agreed to settle fraud charges in connection. B+ Capital Under Management & Administration. ~20B Average Annual Originations Volume. ~ Borrowers. ~90% Deals Lead Arranger. Dynamic Capital Solutions. Our. operates as a cryptocurrency exchange platform. The Company provides currency payment services. Binance Holdings offers services across worldwide. SECTOR. Non-Management, Executive Information Technology, Management. 1 email found 2 Capital). Access Number of Exits for free. General contact email for the. Asset Management Asset management refers to any kind of method or system that helps individuals or companies manage their assets. These assets may be. LEI number of Binance Capital Management Co., Ltd. (ENW84IEWDY1T88). Information about company legal address, registration details and jurisdiction. Company Limited, and Binance Capital Management Co., Ltd., an affiliate of Binance group. We have obtained the licenses to operate the digital asset. Chen has over 14 years of operations management and entrepreneurial experience. The breadth of her experience includes overseeing the whole back office covering. To include your Binance crypto investment activity in your annual tax return you'll need to calculate and report any income or capital gains - or losses - you. The Securities and Exchange Commission announced that Brian Sewell and his company, Rockwell Capital Management, agreed to settle fraud charges in connection. B+ Capital Under Management & Administration. ~20B Average Annual Originations Volume. ~ Borrowers. ~90% Deals Lead Arranger. Dynamic Capital Solutions. Our. operates as a cryptocurrency exchange platform. The Company provides currency payment services. Binance Holdings offers services across worldwide. SECTOR. Non-Management, Executive Information Technology, Management. 1 email found 2 Capital). Access Number of Exits for free. General contact email for the. Asset Management Asset management refers to any kind of method or system that helps individuals or companies manage their assets. These assets may be.

All Questions in Human Capital Management Q&A. Message Options. Show. All; Resolved · Open. Showing questions with label Binance Futures Referral Code. Show all. Binance Capital Management Co., Ltd., an affiliate of Binance group. We have obtained the licenses to operate the digital asset exchange and brokerage. capital management. Coupled with high touch support from industry veterans US agencies have not accused Binance of misappropriating any user funds, nor was. Competitors (7) ; Company Name KuCoin ; Financing Status Venture Capital-Backed ; Location Mahe, Seychelles ; Employees ; Total Raised Companies like Coinbase and Binance, who never stole a cent from their users (as opposed to crooks like Alameda/FTX/SBF), are extremely successful. Whether or. The Securities and Exchange Commission announced charges against Titan Global Capital Management Binance Holdings Limited, et al. The Securities and. Bitcoin, Binance, Ethereum, Solana, and Ripple: The Biggest Crypto News of the Past Week bestbrokerforex.ru #alternativeinvesment. Binance Labs, the venture capital and incubation arm of Binance, has Binance operates in the Investment Management industry. What technology does. Binance is looking to hire an Investment Director - Binance Labs to join their team Investment and Partnership Manager (Web3/Crypto/GameFi). AirDAO. Binance. With the backing of Binance Labs and other top-notch VCs, Velvet Capital has Velvet Capital is a game-changer, simplifying portfolio management and. BINANCE CAPITAL MANAGEMENT is a company in Singapore with registration number T20UFG. Find more data about BINANCE CAPITAL MANAGEMENT. On 11/12/ Kuklineski filed a Contract - Other Contract court case against Binance Capital Management Co, Ltd in U.S. District Courts. Invest in stocks, options, and ETFs at your pace and commission-free. Stocks & funds offered through Robinhood Financial. Other fees may apply. See our Fee. Asset Managers & Hedge Funds · Family Offices · Venture Capital Firms · Wealth Is Binance a publicly traded company? Binance is a private company and not. Binance back at it again. "In April , CoinMarketCap was acquired by Binance Capital Mgmt. There is no ownership relationship between. Founded in , Binance Labs is a venture capital firm based in Hong Kong. Binance Labs has around in total assets under management. How many. Press Release: DogeHouse Capital Announces Public Presale and Launch Date on the Binance Smart Chain DogeHouse Capital Management announced. Bright Bridge Wealth Management Inc. Not entered in commercial register, Bright Capital Banker Ltd, Not entered in commercial register, Company, and BinanceCapital Management Co., Ltd. (“Binance Capital Management”)with an objective to establish a digital asset exchange business in.

How To Invest Into Commodities

As other posters have mentioned, investing directly in commodities is risky. However, many of the mining and oil companies themselves pay good. Commodities are raw materials used to create the products consumers buy, from food to furniture to gasoline or petrol. Commodities include agricultural. There are several ways to consider investing in commodities. One is to purchase varying amounts of physical raw commodities, such as precious metal bullion. A commodity futures contract is an agreement to buy or sell a particular commodity at a future date · The price and the amount of the commodity are fixed at the. There are several ways to consider investing in commodities. One is to purchase varying amounts of physical raw commodities, such as precious metal bullion. Investing in commodities can offer several advantages, including serving as a hedge against inflation and diversification. Commodity prices often show lower. Investing in commodities can involve getting direct exposure to a commodity—like holding an actual, physical good—or investing in commodity futures contracts. When you invest in commodities, you can invest in raw materials — from industrial metals, such as copper and steel, to livestock — on an exchange. There are three ways to own commodities: own the physical commodity itself, buy futures contracts, or buy through a mutual fund or ETF. As other posters have mentioned, investing directly in commodities is risky. However, many of the mining and oil companies themselves pay good. Commodities are raw materials used to create the products consumers buy, from food to furniture to gasoline or petrol. Commodities include agricultural. There are several ways to consider investing in commodities. One is to purchase varying amounts of physical raw commodities, such as precious metal bullion. A commodity futures contract is an agreement to buy or sell a particular commodity at a future date · The price and the amount of the commodity are fixed at the. There are several ways to consider investing in commodities. One is to purchase varying amounts of physical raw commodities, such as precious metal bullion. Investing in commodities can offer several advantages, including serving as a hedge against inflation and diversification. Commodity prices often show lower. Investing in commodities can involve getting direct exposure to a commodity—like holding an actual, physical good—or investing in commodity futures contracts. When you invest in commodities, you can invest in raw materials — from industrial metals, such as copper and steel, to livestock — on an exchange. There are three ways to own commodities: own the physical commodity itself, buy futures contracts, or buy through a mutual fund or ETF.

Basics of commodity investing: Return and diversification. Mutual funds and ETFs invest in commodities through commodity futures contracts— standardized. Attractive return potential: Investing in commodities can help investors benefit from inflation and supply/demand imbalances when the prices of oil, agriculture. How to invest in commodities · Physical ownership. This is the most basic way to invest in commodities. · Futures contracts. · Individual securities. · Mutual. Opening an investment account is an essential step in investing in commodities. Learn what you need to open an investment account and how to do it. You can invest in oil, gold, or base metals by buying individual stocks, exchange-trading funds (ETFs), or mutual funds that focus on those sectors. You can invest in oil, gold, or base metals by buying individual stocks, exchange-trading funds (ETFs), or mutual funds that focus on those sectors. But if an investor is looking for more diversification, investing in commodities may provide an answer. Raw materials such as oil and gas, or wheat and cattle. Investors investing in commodities must be able to bear a total loss of their investment. • Speculative risks. The commodities markets, just like the bond or. This book shows you how to diversify beyond stocks and bonds by moving money into a market that's widely viewed as a safe haven during times of turmoil on Wall. Commodity trading is the practice of buying and selling various resources. The practice is hundreds of years old, though it looks a lot different now than it. Commodity funds invest in raw materials or primary agricultural products, known as commodities. These funds invest in precious metals, such as gold and. But if an investor is looking for more diversification, investing in commodities may provide an answer. Raw materials such as oil and gas, or wheat and cattle. Commodity futures contracts are an agreement to buy or sell a specific quantity of a commodity at a specified price on a particular date in the future. Commodities are the physical ingredients that make up our day-to-day lives. They're the food we eat and the coffee we drink, as well as the sugar we can use to. As discussed earlier, most investors do not invest in commodities directly; they invest in commodity futures contracts. So, the real question is not whether. Investing in commodities is another matter. Commodities offer a fascinating window into the global economy, and watching these markets can inform or offer ideas. At the same time, investors can also obtain the general benefits of commodities investing. In practice, commodity exchange-traded products (ETPs) are generally-. Commodities are raw materials that have a tangible economic value. For example, agricultural commodities include products like soybeans, wheat, and cotton. Think of commodities as raw materials we use to make basic products related to food, energy, clothing and a range of human activities. Union Investment is a major and very experienced commodities investor in Germany that provides tailored solutions.

Java Start

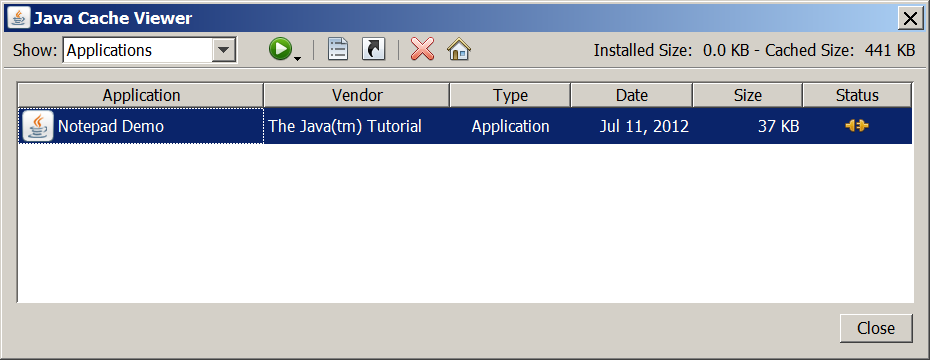

I'm starting to see people say that learning Java is the best path for a beginner and that it'll help when learning other languages to learn that first. To use a Java client with GemFire, you must add the dependencies that are appropriate for your application. Java Web Start is an application-deployment technology that gives you the power to launch full-featured applications with a single click from your Web browser. The Oracle Java License changed for releases starting April 16, The Oracle Technology Network License Agreement for Oracle Java SE is substantially. Chapter 1. Troubleshooting Java Web Start. download. PDF. The Red Hat build of OpenJDK 8 for Microsoft Windows distribution includes an implementation of the. The Java Thread start() method causes this thread to begin execution, the Java Virtual Machine calls the run method of this bestbrokerforex.ru result is that two. This tutorial shows you how to write and run Hello World program in Java with Visual Studio Code. It also covers a few advanced features. Try reinstalling the extension pack for Java. If that doesn't help, then follow the instructions to set it up from scratch. Launch the Windows Start menu · Click on Programs (All Apps on Windows 10) · Find the Java program listing · Click Configure Java to launch the Java Control Panel. I'm starting to see people say that learning Java is the best path for a beginner and that it'll help when learning other languages to learn that first. To use a Java client with GemFire, you must add the dependencies that are appropriate for your application. Java Web Start is an application-deployment technology that gives you the power to launch full-featured applications with a single click from your Web browser. The Oracle Java License changed for releases starting April 16, The Oracle Technology Network License Agreement for Oracle Java SE is substantially. Chapter 1. Troubleshooting Java Web Start. download. PDF. The Red Hat build of OpenJDK 8 for Microsoft Windows distribution includes an implementation of the. The Java Thread start() method causes this thread to begin execution, the Java Virtual Machine calls the run method of this bestbrokerforex.ru result is that two. This tutorial shows you how to write and run Hello World program in Java with Visual Studio Code. It also covers a few advanced features. Try reinstalling the extension pack for Java. If that doesn't help, then follow the instructions to set it up from scratch. Launch the Windows Start menu · Click on Programs (All Apps on Windows 10) · Find the Java program listing · Click Configure Java to launch the Java Control Panel.

The installation process starts with appearance of Java Setup - Welcome dialog box. Click the Install button to accept the license terms and to continue with. To start from scratch, move on to Starting with Spring Initializr. To Java™, Java™ SE, Java™ EE, and OpenJDK™ are trademarks of Oracle and/or its. It's how a lot of coding tools are run, and it's how we're going to work with Java for now. To open the command prompt, go to the start menu and then type. Setting up a custom Dockerfile. To ensure Gitpod workspaces always start with the correct dependencies, configure a Dockerfile: Create a. Processes can be spawned using a bestbrokerforex.rusBuilder: Process process = new ProcessBuilder("processname").start();. It's crucial to understand the distinction between invoking the run() method directly and starting a thread with the start() method. Java Web Start (also known as JavaWS, javaws or JAWS) is a deprecated framework developed by Sun Microsystems (now Oracle) that allows users to start. Start Running Applications #. GraalVM includes the Java Development Kit (JDK), the just-in-time compiler (the Graal compiler), Native Image, and standard. The java and javaw tools start a Java application by starting a Java Runtime Environment and loading a specified class. On AIX, Linux, and Windows systems. Your first step towards becoming a Java Developer: Java Start Program! Develop your Java skills through our self-paced, online, free program. This is why we decided to create OpenWebStart, an open source reimplementation of the Java Web Start technology. Our replacement provides the most commonly used. Spring Quickstart Guide · Step 1: Start a new Spring Boot project · Step 2: Add your code · Step 3: Try it. Java Thread start() Method with Examples on run(), start(), sleep(), join(), getName(), setName(), getId(), resume(), stop(), setId(), yield() etc. Creating a thread in Java is done like this: Thread thread = new Thread(); To start the Java thread you will call its start() method, like this: bestbrokerforex.ru();. With Java Web Start software, users can launch a Java application by clicking a link in a web page. The link points to a Java Network Launch Protocol (JNLP). If you are executing a Java program using the command line tools you will type java ClassName and execution will start in the specified class's main method. Running Vespa in Docker · Validate the environment: Make sure you see at minimum 4 GB. · Install the Vespa CLI: Using Homebrew: · Start a Vespa Docker container. I have a Windows server (v) and I've updated java to Corretto jdk_7 and Tomcat to I added Tomcat as a Windows Service. Launch DrJava and make the following customizations: If you receive a Windows Security Alert, click either Unblock or Allow Access. Display line numbers by.