bestbrokerforex.ru

Recently Added

Social Security Payment Calender

Payment Schedule · Report Changes to Your Case · How to Get Proof of NOTE: If you receive Social Security Retirement, Survivor's, or Disability payments. Be sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount. If you submitted your return electronically. If you received Social Security before. May or if receiving both Social. Security & SSI, Social Security is paid on the 3rd and SSI on the 1st. If you don'. Pension Payment Calendar. Retirement benefits are paid monthly. If your benefit is paid by direct deposit: You have access to your retirement benefit on the. Must be paid once in each calendar month on a day social security number or an employee identification number other than a social security number. Wage and salary earnings from covered employment, up to an amount determined by law (see tax rate table), are subject to the Social Security payroll tax. Wage. Social Security payments typically occur on the third of each month, as well as on the second, third and fourth Wednesday of each month. As a California public school educator, you do not pay into Social Security, so you will not receive Social Security benefits for your CalSTRS-covered. SSI benefits are paid of the 1 st of the month. Unless the 1 st falls on the weekend then the payments will be issued the Friday before the 1 st. Payment Schedule · Report Changes to Your Case · How to Get Proof of NOTE: If you receive Social Security Retirement, Survivor's, or Disability payments. Be sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount. If you submitted your return electronically. If you received Social Security before. May or if receiving both Social. Security & SSI, Social Security is paid on the 3rd and SSI on the 1st. If you don'. Pension Payment Calendar. Retirement benefits are paid monthly. If your benefit is paid by direct deposit: You have access to your retirement benefit on the. Must be paid once in each calendar month on a day social security number or an employee identification number other than a social security number. Wage and salary earnings from covered employment, up to an amount determined by law (see tax rate table), are subject to the Social Security payroll tax. Wage. Social Security payments typically occur on the third of each month, as well as on the second, third and fourth Wednesday of each month. As a California public school educator, you do not pay into Social Security, so you will not receive Social Security benefits for your CalSTRS-covered. SSI benefits are paid of the 1 st of the month. Unless the 1 st falls on the weekend then the payments will be issued the Friday before the 1 st.

You must pay self-employment tax and file Schedule SE (Form or SR) if either of the following applies. Your net earnings from self-employment . Payment calendarCheck mailed August 27Direct deposit August CalSTRS. Menu If you expect to receive both a CalSTRS retirement benefit and a Social Security. STATE SSI PAYMENT PAYROLL DEADLINE. SCHEDULE (SSI PROGRAMS A, B AND E). (FIS/ES AND SERVICES). RFB REFERENCE SCHEDULES MANUAL. Submit forms, calculate your benefit, schedule appointments, send secure messages, and more. How does my PERA benefit affect my social security benefit? Will. The date you get your benefits every month depends on your birthday and the type of benefits you get. View the timing for your upcoming and past payments. Social Security Notices · Reporting and Filing · Forms · Form · Delinquent Schedule MB/SB Benefit Payment Projections Attachment · Schedule R. Employment and Payroll Verification · Your full Social Security Number · Your First and Last Name · Name of Employer (Clark County School District) · A signed. The payments dates for social security benefits, which can be made for a weekly, four (4) week, or thirteen (13) week period, are displayed in chronological. Adding GSA Payroll Calendar to your personal Google Calendar: Use the "Add by URL" function to import an ICS file of the GSA Payroll Calendar to your Google. Annuity Payments. Overview; New Retiree; Direct Deposit; Pay Schedule; Missing Payment; Allotments; Savings Bond; Cost-of-Living insurance coverage will. The table below shows the amount of benefits paid from the OASI Trust Fund. The amounts by type of benefit are estimated. Webinar Calendar. Home · Job Seeker Resources. Order Of Selection For Vocational Rehabilitation Services Social Security Programs and Disability Benefit. Canada Pension Plan (CPP) · Old Age Security (OAS) · Goods and services tax / harmonized sales tax credit (GST/HST credit) · Canada child benefit · Ontario trillium. You can start receiving your Social Security retirement benefits as early as age However, you are entitled to full benefits when you reach your full. Can I receive Disability Insurance and Social Security Disability at the same time? We will schedule a phone interview with you so that you can begin. Social Security benefit payments, retirement & survivors insurance. benefit, calendar years [In millions]. Year, Total, Retired workers. Home/Family and social supports/Income assistance/Payment dates. More topics Repayable money or supplements, such as a security deposit. Find out how. Generally, we cannot pay Retirement, Survivors, and Disability Insurance benefits to noncitizens after their sixth calendar month outside the United States. If you reach the maximum payment, you do not pay any more Social Security tax until the next calendar year. The maximum taxable wage for Social Security is. Under the monthly deposit schedule, deposit employment taxes on payments made during a month by the 15th day of the following month. Semi-weekly depositor.

What Is The Cheapest Way To Send Money To Someone

London-based fintech Wise is a world-class option for sending money internationally and frequently ranks as the cheapest way to transfer money internationally. You may want to use a wire transfer if you're sending a large amount of money. Other options include paper checks and peer-to-peer payment apps like Venmo. Funding your money transfer with a bank transfer is usually the cheapest way to send money abroad. Get the best rate out there. Get the cheapest rate possible. How to send cash overseas cheaply If you need to transfer money to friends, family or businesses overseas (or even to your own overseas account), don't just. You and your recipients can track your transfer every step of the way. Great Value. Enjoy consistently great rates and no hidden fees. Whether using the app or. These international money transfer companies move money in a variety of ways, but as a general rule they tend to be cheaper than sending money directly through. With Western Union, you can send money to loved ones across the US. Transfer money for cash pickup at more than 61, agent locations or send money. Cash pickup – sending a payment for cash pickup can often be the fastest way to get your money into your recipient's hands. It's also usually one of the most. Avoid wire transfers where you send the foreign currency (meaning the sender's bank converts at a bad rate). For same-currency transfers without. London-based fintech Wise is a world-class option for sending money internationally and frequently ranks as the cheapest way to transfer money internationally. You may want to use a wire transfer if you're sending a large amount of money. Other options include paper checks and peer-to-peer payment apps like Venmo. Funding your money transfer with a bank transfer is usually the cheapest way to send money abroad. Get the best rate out there. Get the cheapest rate possible. How to send cash overseas cheaply If you need to transfer money to friends, family or businesses overseas (or even to your own overseas account), don't just. You and your recipients can track your transfer every step of the way. Great Value. Enjoy consistently great rates and no hidden fees. Whether using the app or. These international money transfer companies move money in a variety of ways, but as a general rule they tend to be cheaper than sending money directly through. With Western Union, you can send money to loved ones across the US. Transfer money for cash pickup at more than 61, agent locations or send money. Cash pickup – sending a payment for cash pickup can often be the fastest way to get your money into your recipient's hands. It's also usually one of the most. Avoid wire transfers where you send the foreign currency (meaning the sender's bank converts at a bad rate). For same-currency transfers without.

At bestbrokerforex.ru, it's easy and affordable to transfer money online. Save money. Live better.

Wise uses the mid-market rate and transparent fees to help you send money in 50+ currencies. MoneyGram has fast cash pick-up transfers to more than , CurrencyFair can be a cheap international money transfer service with quick delivery times on many currency routes. There's a low, flat fee per transfer, and. Paying with Debit Card is quick and easy. It's also cheaper than a credit card. Learn more. Transfer money quickly and securely with PayPal. Send money online to friends and family in the US for free when you use your PayPal balance or bank account. The cheapest and easiest way to send someone money now is cryptocurrency. Tip her some dogecoin, or send her some btc. instant, free of charge. 3 Ways to Send Money. Electronic Funds Transfer (EFT). Paid service with a fee; Funds post to an incarcerated person account within 1 – 3 days; Friends and. What is the cheapest way to send money to the USA? The cheapest way to send money to the USA is by using a money transfer provider and paying via a bank. At OFX, you receive fee-free transfers when you send money internationally in USD. Occasionally, third-party banks may deduct a fee from your transfer before. An international bank transfer is usually the best way to transfer money internationally because it is secure, quick, and cheaper than other methods. Transfer money with low fees and the Revolut exchange rate. Looking for the cheapest way to send money to the USA? Keeping international money transfers. You can use a money transfer app (Remit Choice). Its the cheapest and easiest. Cheaper transfers abroad - free from hidden fees and exchange rate markups. · Check exchange rates - see on the app how exchange rates have changed over time. When using money transfer services, bank transfers are more often the cheapest way of sending money. To recap from our earlier point, using your bank account to. The best ways to transfer money to Mexico ; Boss Revolution, Starts at $ (debit card or in-store) $ (credit card), cash pickup bank deposit ; MoneyGram. Paysend lets you transfer money either to a bank account or directly to a card, using just the recipient's name and card number. Sending to a bank is done with. Ways to Send Money ; To an account, Yes, Yes ; Cash to a person, No, No ; How to enroll, Online & mobile, Online & mobile ; Locations supported, U.S. only. U.S. &. CurrencyFair can be a cheap international money transfer service with quick delivery times on many currency routes. There's a low, flat fee per transfer, and. With low fees and great exchange rates that are affordable, MoneyGram is The best ways to send money from the United States to Venezuela with MoneyGram. Cheapest Remittance Providers Reviewed · 1. Wise - Best for Bank Transfers · 2. Remitly - Best for Cash Pick-ups · 3. WorldRemit - Best for Mobile Money · 4. Money transfer company A money transfer company is usually the cheapest way to get money to someone overseas. The company can either move the money to the.

Best Traditional Ira Interest Rates

Flexible CD IRA · Call us for rates or to open an account: · For Featured CD IRA, –% depending on balance and term · % depending on. In your best interest. Account Login. Sign into Star One Online Banking. For Competitive IRA interest rates; Knowledgeable, qualified staff; Monthly. Best IRA CD Rates ; NASA Federal Credit Union IRA CD: % to % APY ; Connexus Credit Union IRA Share Certificates: % to % APY ; Discover® IRA CD. Certificate Term*, Dividend Rate, Annual Percentage Yield ; 91 Days, %, % APY ; 6 Months, %, % APY ; 12 Months, %, % APY ; 18 Months, %. Available at terms of six months to five years. Traditional IRA. Best if The Dividend Rates and Annual Percentage Yields are the prospective rates. IRA Certificates of Deposit (CDs) ; Retirement Flex 10 Month CD · %, % ; Retirement Flex 20 Month CD · %, % ; Retirement Flex 30 Month CD · %. Visit now to compare TD Bank® Individual Retirement Account interest rates, terms & features to find the best IRA for you. For assistance, call a Banker. Choose a great rate. Make it count. Explore Synchrony Bank IRA CD rates and terms. IRA CDs ; 48 Months, %, %, $ ; 54 Months, %, %, $ Flexible CD IRA · Call us for rates or to open an account: · For Featured CD IRA, –% depending on balance and term · % depending on. In your best interest. Account Login. Sign into Star One Online Banking. For Competitive IRA interest rates; Knowledgeable, qualified staff; Monthly. Best IRA CD Rates ; NASA Federal Credit Union IRA CD: % to % APY ; Connexus Credit Union IRA Share Certificates: % to % APY ; Discover® IRA CD. Certificate Term*, Dividend Rate, Annual Percentage Yield ; 91 Days, %, % APY ; 6 Months, %, % APY ; 12 Months, %, % APY ; 18 Months, %. Available at terms of six months to five years. Traditional IRA. Best if The Dividend Rates and Annual Percentage Yields are the prospective rates. IRA Certificates of Deposit (CDs) ; Retirement Flex 10 Month CD · %, % ; Retirement Flex 20 Month CD · %, % ; Retirement Flex 30 Month CD · %. Visit now to compare TD Bank® Individual Retirement Account interest rates, terms & features to find the best IRA for you. For assistance, call a Banker. Choose a great rate. Make it count. Explore Synchrony Bank IRA CD rates and terms. IRA CDs ; 48 Months, %, %, $ ; 54 Months, %, %, $

High Yield IRA CDs from Discover offer both Traditional and Roth IRAs with high interest rates. View our IRA CD interest rates and calculator today. Traditional IRA earnings grow tax deferred To qualify for the rate bump, customers must own an eligible TD Bank personal checking account in good standing at. For a traditional IRA, you can expect to pay taxes on the money you withdraw. Who has the best IRA CD rates? Many banks offer IRA CDs and will often have. You'll earn even higher rates when you invest $10, or more. You may use your balance to qualify for Premier Checking. On select CDs, you may have interest. Features · Competitive fixed interest rates and annual percentage yields · Interest compounded daily and paid at maturity on 3-, 6- and 9-month CDs · Interest. better interest rate of return than a savings account. Broad selection Banks offer traditional CDs and often have you forfeit the interest payment to redeem. View All CD and IRA Rates Customize your investment needs, receive a guaranteed rate of return and select the interest payment plan that works best for you. Compare the best IRA CD rates ; Elements Financial. 12 Month Flex IRA Special. (19 Reviews). % ; Hudson Valley Federal Credit Union. 12 Month Flex IRA. These FDIC insured1, interest-bearing accounts can help you earn a higher fixed interest rate than you might with a traditional savings accounts. At Bar. Short-Term Certificate Rates ; %, %, % ; %, %, %. An IRA Savings account can help you prepare for retirement, or how you can grow your savings with a guaranteed fixed rate of return with an IRA CD. IRA Raise Your Rate CD. Best for: Retirement savings with the ability to raise your CD rate. Traditional or Roth IRA through a transfer, rollover, or. The Highest Fixed Annuity Rates For August As of August 1, , Wichita Life offers the best fixed annuity rates, % for a 5-year term, one of the best. Traditional IRA Features · Great interest rates — consistently among the best in the country · No minimum deposit. · No fee to transfer funds in and out of Alliant. IRA Rates ; Term13 Month (90 Day), Interest Rate%, Annual Percentage Yield (APY)% ; Term16 Month ( Day), Interest Rate%, Annual Percentage Yield . When the stock market is volatile and interest rates are up, those at or near retirement might consider an IRA CD for part of their retirement savings. An IRA. better interest rate of return than a savings account. Broad selection Banks offer traditional CDs and often have you forfeit the interest payment to redeem. IRA Money Market Rates ; Dividend: %, APY: %, Minimum Deposit: $2, ; Dividend: %, APY: %, Minimum Deposit: $10, ; Dividend: %. Contribution · Shop for interest rates, term lengths, and advantages among banks and credit unions. · Choose whether you want a Roth IRA CD or a traditional IRA. Certificate Calculator ; 60 Month Certificate. %. % ; Rates effective as of July 2, * APY = Annual Percentage Yield. IRA Certificates are available.

High Interest Credit Union Accounts

:max_bytes(150000):strip_icc()/best-high-interest-checking-accounts-4164760_V2-b4cbf503df674159a7f5e3e4a4439d87.png)

Save more with PenFed's online high yield savings account, offering high online deposit rates with free online transfers. Holiday Club Savings Account · Minimum $5 to open account each year · Ability to arrange direct deposit or automatic transfers to save painlessly · Funds. Take your savings further with a High Earning Savings Account. Earn with rates up to % APY* and enjoy the flexibility to access your money 24/7. Money Market Account. iQ's money market accounts offer competitive interest rates and give you more flexibility with your savings. Maintain a balance of $1, Launch your savings with our exclusive, limited-time, Sky High Savings % APY* 6-month locked rate with an Elite Level NOVA Perks™ Checking Account. * Annual. The High Yield Savings Account is a tiered rate account. 0% APY for a balance less than $2, and % APY for balances $2, and more. The APY for. A high yield savings account pays dividends at a higher rate—or annual percentage yield (APY)—than traditional savings accounts, which means you earn more. Advantis Credit Union offers 3 high interest savings account solutions. All the power of high-growth interest rates. All the security of a savings account. Reap the benefits. · Checking: Rate of Earn up to % Annual Percentage Yield (APY) APY up to $15,; Earn up to % Annual Percentage Yield (APY). Save more with PenFed's online high yield savings account, offering high online deposit rates with free online transfers. Holiday Club Savings Account · Minimum $5 to open account each year · Ability to arrange direct deposit or automatic transfers to save painlessly · Funds. Take your savings further with a High Earning Savings Account. Earn with rates up to % APY* and enjoy the flexibility to access your money 24/7. Money Market Account. iQ's money market accounts offer competitive interest rates and give you more flexibility with your savings. Maintain a balance of $1, Launch your savings with our exclusive, limited-time, Sky High Savings % APY* 6-month locked rate with an Elite Level NOVA Perks™ Checking Account. * Annual. The High Yield Savings Account is a tiered rate account. 0% APY for a balance less than $2, and % APY for balances $2, and more. The APY for. A high yield savings account pays dividends at a higher rate—or annual percentage yield (APY)—than traditional savings accounts, which means you earn more. Advantis Credit Union offers 3 high interest savings account solutions. All the power of high-growth interest rates. All the security of a savings account. Reap the benefits. · Checking: Rate of Earn up to % Annual Percentage Yield (APY) APY up to $15,; Earn up to % Annual Percentage Yield (APY).

Share: Earn more than 10x the national average rate and reach your savings goal faster with Citadel's High Yield Savings Account. You'll benefit from a great. Move your money from another institution to a CU1 High Yield Savings Account and start earning 8X higher than the national average 1 with our best savings. Our High Yield Checking™ earns % APY1 and is bundled with a High Yield Savings Account, where the earnings from your checking account are deposited and earn. High Interest Checking ; $0 - $1,, %, % ; $1, - $5,, %, % ; $5,+, %, %. Credit unions generally offer higher interest rates for deposit accounts, such as checking and savings. Credit unions generally offer low interest rates for. The Higher Yield Savings Account earns a minimum of % when the balance reaches or exceeds $2, Dividend Rates. Please refer to our rates page for full. Earn more interest with a high yield savings account. Quickly build your savings with rates 15x the bank industry average! With a Serious Interest Checking® high interest checking account, you can earn % APY* on balances up to $15, when you have 12 posted debit card or credit. Get started with our basic savings account and earn a market-leading rate of % APY. Plus, you'll have the flexibility to withdraw what you need—anytime. Move your money to a Vibrant checking or savings account and start earning up to x more interest on your balance. Move your money to a Vibrant checking or savings account and start earning up to x more interest on your balance. I have a savings, 2 checking accounts, the signature visa card, and a mortgage with them. You should be aware that their savings acct interest. Most checking accounts pay little to no interest. In fact, our High-Yield Checking (HYC) pays several times more than the nationwide average* APY (annual. High Yield Savings Account Features Earn % APY 1 on balances of $ or more Fully insured up to any amount Easy access to your money . Save more with PenFed's online high yield savings account, offering high online deposit rates with free online transfers. How is it different from a RewardPlus checking account? The Income Checking account offers a high-interest rate of % annual percentage yield APY on balances. Infuze Credit Union members can earn our best savings rate, % APY* on balances up to $5,, by linking a High-Rate Checking account and performing basic. Member Reviews: · Earn % APY† on the first $1, you deposit. · Just for college-aged young adults 18 to 24 years-old. · Get saving with any amount. No. Save your bacon · Earn interest on accounts over $50 · Unlimited number of Consumers Credit Union savings accounts · Customizable account nicknames · 24/7 account.

Cryptocurrency Trading Prices

Coinranking gives you price data of all cryptocurrencies. Here, you can check for real-time prices, market caps and historical price data. Enjoy greater capital efficiency in crypto-trading through better price discovery in a transparent and liquid futures market. Get enhanced pricing information. Today's Cryptocurrency Prices ; 1. B · Bitcoin. BTC. $55, $55, %. % ; 2. E · Ethereum. ETH. $2, $2, %. %. Today's cryptocurrency prices ; BTCBitcoin, $54, +% ; ETHEthereum, $2, +% ; USDTTether, $ % ; USDCUSD Coin, $ %. cryptocurrency” advisory trading businesses touting traded securities that offer exposure to the price movements of bitcoin futures contracts. The trading volume of Bitcoin (BTC) is $17,,, in the last 24 hours, representing a % decrease from one day ago and. Yahoo Finance's complete list of crypto currencies offers up-to-the-minute prices, percentage change, volume, open interest, and daily charts. BTC. Bitcoin. $53, +% ; ETH. Ethereum. $2, +% ; BNB. BNB. $ +%. Cryptocurrency Prices ; Bitcoin. BTCUSD. $56, ; Ether. ETHUSD. $2, ; Tether. USDTUSD. $ ; Solana. SOLUSD. $ ; USD Coin. USDCUSD. $ Coinranking gives you price data of all cryptocurrencies. Here, you can check for real-time prices, market caps and historical price data. Enjoy greater capital efficiency in crypto-trading through better price discovery in a transparent and liquid futures market. Get enhanced pricing information. Today's Cryptocurrency Prices ; 1. B · Bitcoin. BTC. $55, $55, %. % ; 2. E · Ethereum. ETH. $2, $2, %. %. Today's cryptocurrency prices ; BTCBitcoin, $54, +% ; ETHEthereum, $2, +% ; USDTTether, $ % ; USDCUSD Coin, $ %. cryptocurrency” advisory trading businesses touting traded securities that offer exposure to the price movements of bitcoin futures contracts. The trading volume of Bitcoin (BTC) is $17,,, in the last 24 hours, representing a % decrease from one day ago and. Yahoo Finance's complete list of crypto currencies offers up-to-the-minute prices, percentage change, volume, open interest, and daily charts. BTC. Bitcoin. $53, +% ; ETH. Ethereum. $2, +% ; BNB. BNB. $ +%. Cryptocurrency Prices ; Bitcoin. BTCUSD. $56, ; Ether. ETHUSD. $2, ; Tether. USDTUSD. $ ; Solana. SOLUSD. $ ; USD Coin. USDCUSD. $

USDT. Tether. ₹ ; BTC. Bitcoin. ₹50,39, ; ETH. Ethereum. ₹2,13, ; USDC. USD Coin. ₹ ; SOL. Solana. ₹11, Your go-to page for crypto coins ; LINK · 14, USD ; DOT · 15, USD ; BCH · 16, USD ; DAI · 17, USD. Here at bitFlyer, an account creation/maintenance and deposits are FREE! Expect low fees for any withdrawal and according to your trading volumes/frequency. Buying cryptos means you're taking ownership of the digital asset, so you'll need an account with an exchange and a digital wallet to store the crypto in. Total cryptocurrency trading volume in the last day is at $ Billion. Bitcoin dominance is at % and Ethereum dominance is at %. Related to this, there has also been a high degree of volatility in the prices of many cryptocurrencies. For example, the price of Bitcoin increased from about. How to trade crypto? · Choose a cryptocurrency exchange that supports trading. · Create an account on the chosen platform and perform ID verification, known as. Top Coins by Market Cap ; 1. BTC price logo. BTC. Bitcoin. $ ; 2. ETH price logo. ETH. Ethereum. $ ; 3. USDT price logo. USDT. Tether. $ ; 4. BNB. Bitcoin news, USD price, real-time (live) charts. Learn about BTC value, bitcoin cryptocurrency, crypto trading, and more. Check the current price, daily change, and market capitalization on the bestbrokerforex.ru cryptocurrency prices page. Follow the live price charts and start trading. Follow regularly updated rates of the most popular cryptocurrencies. Quotations are expressed in USD or BTC. Look for the virtual currency of your choice. Visualize the Crypto Market with COIN's Comprehensive Heatmap. Discover Current Cryptocurrency Prices. Explore Market Capitalizations of Different Coins. The crypto global market cap is T, a % decrease over the last day. Tech analysis of the biggest cryptos. View All. Coin. Price. Last 7 Days. At CryptoCompare, we strive to find the best places to store, trade and mine cryptocurrency. Our featured lists can help you easily navigate the crypto world. Most Active Cryptocurrencies. Start Trading Futures ; Tron. ; Toncoin. ; Cardano. ; Lido wstETH. 2, View crypto prices and charts, including Bitcoin, Ethereum, XRP, and more. Earn free crypto. Market highlights including top gainer, highest volume. The live price of Bitcoin is $ 54, per (BTC / USD) with a current market cap of $ 1,B USD. hour trading volume is $ B USD. BTC to USD price. These platforms tend to offer lower trading costs but fewer crypto features. Cryptocurrency exchanges. There are many cryptocurrency exchanges to choose. Top Cryptocurrencies ; Toncoin. 10|TON. % ; Cardano. 11|ADA. +% ; Avalanche. 12|AVAX. +% ; Shiba Inu. 13|SHIB. + The current price of Bitcoin (BTC) is 54, USD — it has risen % in the past 24 hours. Try placing this info into the context by checking out what coins.

Amazon Kom

bestbrokerforex.ru is the leading U.S. e-commerce retailer and among the top e-commerce sites globally. bestbrokerforex.ru also includes Amazon Web Services (AWS), the. Amazon Shopping offers app-only benefits to help make shopping on Amazon faster and easier than shopping on your desktop. bestbrokerforex.ru, Seattle, Washington. likes · talking about this · were here. Official Facebook page of bestbrokerforex.ru bestbrokerforex.ru, Inc., doing business as Amazon is an American multinational technology company, engaged in e-commerce, cloud computing, online advertising. bestbrokerforex.ru is the leading U.S. e-commerce retailer and among the top e-commerce sites globally. bestbrokerforex.ru also includes Amazon Web Services (AWS), the. IMDb ; Type of site. Database ; Available in, English ; Owner, Amazon ; Founder(s) · Col Needham ; Subsidiaries · Box Office Mojo. Enjoy Amazon Prime Video in over countries and territories around the globe! Download movies and TV shows using Wi-Fi or cellular networks. Advertising · Amazon Business · Amazon Music · Amazon Prime · AWS · Books and authors · Community · Company News. Delivering smiles one box at a time. Use @AmazonHelp for customer support and @AmazonNews for the latest. bestbrokerforex.ru Joined February 50 Following 6M. bestbrokerforex.ru is the leading U.S. e-commerce retailer and among the top e-commerce sites globally. bestbrokerforex.ru also includes Amazon Web Services (AWS), the. Amazon Shopping offers app-only benefits to help make shopping on Amazon faster and easier than shopping on your desktop. bestbrokerforex.ru, Seattle, Washington. likes · talking about this · were here. Official Facebook page of bestbrokerforex.ru bestbrokerforex.ru, Inc., doing business as Amazon is an American multinational technology company, engaged in e-commerce, cloud computing, online advertising. bestbrokerforex.ru is the leading U.S. e-commerce retailer and among the top e-commerce sites globally. bestbrokerforex.ru also includes Amazon Web Services (AWS), the. IMDb ; Type of site. Database ; Available in, English ; Owner, Amazon ; Founder(s) · Col Needham ; Subsidiaries · Box Office Mojo. Enjoy Amazon Prime Video in over countries and territories around the globe! Download movies and TV shows using Wi-Fi or cellular networks. Advertising · Amazon Business · Amazon Music · Amazon Prime · AWS · Books and authors · Community · Company News. Delivering smiles one box at a time. Use @AmazonHelp for customer support and @AmazonNews for the latest. bestbrokerforex.ru Joined February 50 Following 6M.

Guys I've got a question. I'm in Germany and thankfully the second season is on Amazon Prime. Previously new episodes were available every. Amazon Prime is included with your Metro Flex Plus plan. Enjoy free two day shipping, get access to Prime Video's collection of movies and TV shows. bestbrokerforex.ru, Inc. (NASDAQ: AMZN) today announced financial results for its first quarter ended March 31, Net sales increased 13% to $ billion in the. bestbrokerforex.ru, Inc. is an online retailer that offers a wide range of products. The Company products include books, music, computers, electronics, and numerous. bestbrokerforex.ru, Inc., doing business as Amazon is an American multinational technology company, engaged in e-commerce, cloud computing, online advertising. Amazon Conditions of Use (e.g. bestbrokerforex.ru) and Privacy Notice (e.g. bestbrokerforex.ru) for your country. Links to these terms and. 57 minutes ago. Enjoy The Lord of the Rings: The Rings of Power and other Amazon Originals, popular movies, and hit TV shows — all available with your Prime membership. Sign up for the latest news, facts, analysis, and original stories about Amazon, delivered to you weekly. Free shipping on millions of items. Get the best of Shopping and Entertainment with Prime. Enjoy low prices and great deals on the largest selection of. bestbrokerforex.ru, Inc. is an online retailer that offers a wide range of products. The Company products include books, music, computers, electronics, and numerous. Amazon Shopping offers app-only benefits to help make shopping on Amazon faster and easier than shopping on your desktop. Prime members can scan their Whole Foods Market or Amazon app and score an extra 10% off storewide sales.¹ Plus, scan for Prime member deals: special discounts. Integrated Handlebar Mount by KOM Cycling - Wahoo Mount for Integrated Handlebars Made with CNC Alumninumn fits Bars Such as Shimano, FSA, Canyon, Ritchey. Amazon business. With our keyword data tools and services, you can uncover product opportunities, understand the competitive landscape, create successful. AMAZON PRIME VIDEO for 5$? Discussion. A friend of mine told me about this he said it's due to difference of regional prices. I got it from. bestbrokerforex.ru, Seattle, Washington. likes · talking about this · were here. Official Facebook page of bestbrokerforex.ru Delivering smiles one box at a time. Use @AmazonHelp for customer support and @AmazonNews for the latest. bestbrokerforex.ru Joined February 50 Following 6M. Amazon Prime Members get free tickets to exclusive advance screenings of Amazon Original movies and series plus concessions and photo moments. Find KOMONO watches at low prices. Shop online for men's, women's, and kids' watches and accessories at bestbrokerforex.ru

What Should I Expect From A Financial Advisor

A financial adviser can help you set financial goals so you feel confident that your future plans are achievable. If you're not on track to achieving your goals. You'll want to know what's happening with your money! You'll also want to know what you can expect going forward. Keep in mind, money compounds over time -. Here's some of the key financial information to gather in advance so your CFP® professional can start to understand your current situation. How long has your firm been in business? · How much funds do you have under management? · Do you hold a professional certification? · What is the. By planning ahead for life's big events, you can be better positioned to reach your financial goals — and more prepared to meet any unexpected challenges. Your Financial Advisor can also work with your tax and legal advisors to help create a personalized plan that suggests ways to help reduce your taxes. A knowledgeable, honest planner can help you avoid the big mistakes--tax traps, estate mishaps, errors in timing withdrawals, behavioral finance. A hypocrite! And most financial advisors are hypocrites because they expect clients to invest with them or spend thousands of dollars on a financial plan when. A financial advisor helps you develop a long-term financial strategy, chart the short-term steps to help you stay consistent and adapt to unexpected events in. A financial adviser can help you set financial goals so you feel confident that your future plans are achievable. If you're not on track to achieving your goals. You'll want to know what's happening with your money! You'll also want to know what you can expect going forward. Keep in mind, money compounds over time -. Here's some of the key financial information to gather in advance so your CFP® professional can start to understand your current situation. How long has your firm been in business? · How much funds do you have under management? · Do you hold a professional certification? · What is the. By planning ahead for life's big events, you can be better positioned to reach your financial goals — and more prepared to meet any unexpected challenges. Your Financial Advisor can also work with your tax and legal advisors to help create a personalized plan that suggests ways to help reduce your taxes. A knowledgeable, honest planner can help you avoid the big mistakes--tax traps, estate mishaps, errors in timing withdrawals, behavioral finance. A hypocrite! And most financial advisors are hypocrites because they expect clients to invest with them or spend thousands of dollars on a financial plan when. A financial advisor helps you develop a long-term financial strategy, chart the short-term steps to help you stay consistent and adapt to unexpected events in.

investors expect their portfolios to generate an percent return annually over the long term after inflation. Financial advisors said a How do financial advisors help navigate market ups and downs? Your financial advisor aligns your investment recommendations with your financial goals, risk. According to Loper, certified financial planners (CFP's, for short) can typically help with a variety of concerns. “CFP's can help people who need a strategy to. Industry studies estimate that professional financial advice can add up to % to portfolio returns over the long term, depending on the time period and how. Meeting a financial advisor is an opportunity for you to ask questions, talk about your long-term goals and current priorities and get to know each other. Financial planners develop personal financial plans for individuals and families. They analyze clients' net worth, financial resources, lifestyle preferences. By employing a reputable financial advisor to help you achieve your goals, you'll be making an investment in your future prosperity. Furthermore, industry studies estimate that professional financial advice can add up to % to portfolio returns over the long term, depending on the time. Once you have selected an advisor, expect them to gather more information on your goals, desires, and past financial experiences. They'll want a big picture. According to Loper, certified financial planners (CFP's, for short) can typically help with a variety of concerns. “CFP's can help people who need a strategy to. What characteristics do people want from an advisor? ; Trustworthy, %, % ; Ability to listen to and understand your goals, %, % ; Clearly. A major part of a personal financial advisor's job is making clients feel comfortable. Advisors must establish trust with clients and respond well to their. 7 Things to do to prepare for your first financial advisor meeting · List your assets and liabilities · Outline your income and expenses · Write down your goals. How long has your firm been in business? · How much funds do you have under management? · Do you hold a professional certification? · What is the. A hypocrite! And most financial advisors are hypocrites because they expect clients to invest with them or spend thousands of dollars on a financial plan when. 1. Create a customized long-term strategy · 2. Provide a holistic approach to your finances · 3. Plan your retirement · 4. Prepare for the unexpected · 5. Replace. Financial advisors can help individuals and companies reach their financial goals sooner by providing their clients with strategies and ways to create more. Your Financial Advisor can also work with your tax and legal advisors to help create a personalized plan that suggests ways to help reduce your taxes. Meeting with a Financial Advisor for the first time, you should expect a friendly, casual conversation — you're just getting to know each other. Financial planners assist clients in managing their finances by developing financial strategies, offering investment advice, and creating tax plans. Planners.

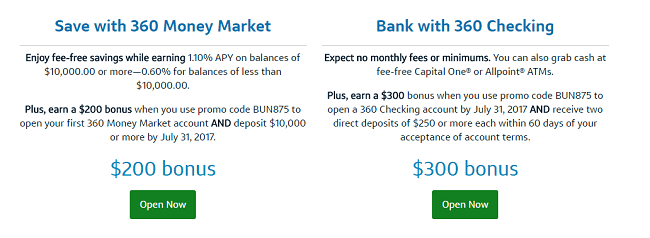

Capital 1 Checking Account Bonus

New SoFi Bank customers can earn up to $ by opening a Checking and Savings account. You'll need a direct deposit to earn the bonus. The amount of your total. This offer is great for anyone that doesn't already have a checking account with Capital One You can earn the bonus with just a couple of direct deposits. You likely know that you have to set up and receive at least 2 direct deposits each of $ or more within 75 days of opening the account. Capital One [bestbrokerforex.ru] is offering a $ Cash Bonus, with code REWARD, when you open an Eligible Checking Account and Make At Least 2 Qualifying. Open an online checking account with cashback debit today. Earn cash back, enjoy no fees, and experience the freedom of a free checking account. APY is variable and subject to change at any time without notice. No monthly service charge or minimum balance requirement for the Star Plus Checking account. 1. Earn a bonus of $ to $1,, depending on deposit amount. A deposit of $20, will earn $; a deposit of $50, will earn $; and a deposit of $, Capital One Checking $ Bonus Earn $ from Capital One by opening a new personal checking account. At no extra cost to you, some or all of the. Earn a one-time cash bonus of $2, once you spend $30, in the first 3 months, plus earn an additional $2, cash bonus for every $K spent during the. New SoFi Bank customers can earn up to $ by opening a Checking and Savings account. You'll need a direct deposit to earn the bonus. The amount of your total. This offer is great for anyone that doesn't already have a checking account with Capital One You can earn the bonus with just a couple of direct deposits. You likely know that you have to set up and receive at least 2 direct deposits each of $ or more within 75 days of opening the account. Capital One [bestbrokerforex.ru] is offering a $ Cash Bonus, with code REWARD, when you open an Eligible Checking Account and Make At Least 2 Qualifying. Open an online checking account with cashback debit today. Earn cash back, enjoy no fees, and experience the freedom of a free checking account. APY is variable and subject to change at any time without notice. No monthly service charge or minimum balance requirement for the Star Plus Checking account. 1. Earn a bonus of $ to $1,, depending on deposit amount. A deposit of $20, will earn $; a deposit of $50, will earn $; and a deposit of $, Capital One Checking $ Bonus Earn $ from Capital One by opening a new personal checking account. At no extra cost to you, some or all of the. Earn a one-time cash bonus of $2, once you spend $30, in the first 3 months, plus earn an additional $2, cash bonus for every $K spent during the.

Capital One checking account offers an APY of % (APY stands for annual percentage yield, rates may change). What are the account minimums for Capital One. APY is variable and subject to change at any time without notice. No monthly service charge or minimum balance requirement for the Star Plus Checking account. 1. Capital One $ Checking Bonus · Open Checking. Open a new account with promo code CHECKING · Get direct deposits. Set up and receive at least 2 direct. Capital One [bestbrokerforex.ru] is offering a $ Cash Bonus, with code REWARD, when you open an Eligible Checking Account and Make At Least 2 Qualifying. For Savers & Spenders. $ bonus when you make 5 Checking Debit Card purchases or CheckmateSM deposits in the first 45 days of opening your new account. Open a new checking account by 9/30/ Enter your offer code. · Make direct deposits totaling $ or more within 90 days of account opening. The $ bonus. Open an online checking account with cashback debit today. Earn cash back, enjoy no fees, and experience the freedom of a free checking account. Capital One's Checking account features no monthly fees, including overdraft fees, and no minimum balance or deposit requirements. Capital One checking account is a flexible online banking account offering no monthly maintenance fees, no-fee overdraft options, and access to over 70, Earn up to a $ bonus when you open a new, eligible US Bank business checking account online with promo code Q3AFL24 and complete qualifying activities. To qualify for Bonus: Apply for your first Discover Online Savings Account, enter Offer Code CY at application, deposit into your Account a total of at least. Set up and receive at least 2 direct deposits, each of $ or more, within 75 days of account opening. Your $ bonus will be deposited into your new. Capital One Checking Account Additional Info · When you set up free direct deposit, you may receive your money up to 2 days sooner. · You have three options. Capital One offers a free checking account, although it doesn't offer an account opening bonus. You won't pay a monthly fee nor will you pay any overdraft fees. Earn up to a $ bonus when you open a new, eligible US Bank business checking account online with promo code Q3AFL24 and complete qualifying activities. Capital One referral link to open a Savings or Checking account or a $25– bonus when you open a Money Ma. Capital One offers a free checking account, although it doesn't offer an account opening bonus. You won't pay a monthly fee nor will you pay any overdraft fees. Bonus will be reported to the IRS for income tax purposes. 9 Better Deposit Rates: CitizensPlus deposit rate benefits are compared to One Deposit Savings and. Open a new checking account by 9/30/ Enter your offer code. · Make direct deposits totaling $ or more within 90 days of account opening. The $ bonus. How To Earn Bonus · Open Checking. Open a new account with promo code CHECKING · Get direct deposits. Set up and receive at least 2 direct deposits, each.

Blanket Bond

:max_bytes(150000):strip_icc()/blanket-bond-4200574-3x2-final-2-3da8b703b29742dfab48cf9897e8d037.png)

(b) For the purposes of this Article, the term “blanket bond” means a single surety instrument, executed by an admitted surety that is conditioned for the. Bankers Blanket Bond insurance provides financial institutions with protection against direct financial loss sustained as a result of criminal activity. The. The most common form of blanket bond used by commercial and savings banks is the Financial Institution. Bond, Standard Form No. Other forms may be. The meaning of COMMERCIAL BLANKET BOND is a fidelity bond or form of insurance issued to business firms that covers all losses due to theft by employees. blanket bond effecting such coverage. Each surety bond shall be conditioned upon the faithful performance of the duties of the office or offices covered and. Bonds required of officers and employees; blanket bond. A. The board of directors of every trust subsidiary shall require bonds from all of the. The blanket bond covers up to. $, in estate funds, i.e. cash and assets liquidated into cash, per case. The chapter 7 blanket bond renews every year on. § Bonds required of officers and employees; blanket bond. A. The board of directors of every bank shall require bonds from all of the active officials. ICI Mutual's Investment Company Blanket Bond (Bond) protects against specified losses caused by employee theft, third-party fraud and various other types of. (b) For the purposes of this Article, the term “blanket bond” means a single surety instrument, executed by an admitted surety that is conditioned for the. Bankers Blanket Bond insurance provides financial institutions with protection against direct financial loss sustained as a result of criminal activity. The. The most common form of blanket bond used by commercial and savings banks is the Financial Institution. Bond, Standard Form No. Other forms may be. The meaning of COMMERCIAL BLANKET BOND is a fidelity bond or form of insurance issued to business firms that covers all losses due to theft by employees. blanket bond effecting such coverage. Each surety bond shall be conditioned upon the faithful performance of the duties of the office or offices covered and. Bonds required of officers and employees; blanket bond. A. The board of directors of every trust subsidiary shall require bonds from all of the. The blanket bond covers up to. $, in estate funds, i.e. cash and assets liquidated into cash, per case. The chapter 7 blanket bond renews every year on. § Bonds required of officers and employees; blanket bond. A. The board of directors of every bank shall require bonds from all of the active officials. ICI Mutual's Investment Company Blanket Bond (Bond) protects against specified losses caused by employee theft, third-party fraud and various other types of.

A blanket fidelity bond is a class of dishonesty bonds, which provide coverage for an employer to protect them from employee theft and misconduct. This coverage. Blanket bond coverage may be by one or more blanket bonds issued by a surety blanket bond as if the individuals were covered by an individual bond. Bonds or blanket bond as security coverage. (a) In generalA county may comply with section (b) (relating to required security) by providing bonds or. Define Bankers Blanket Bond. means a fidelity bond or insurance policy providing coverage for losses resulting from criminal activities and other actions of. A banker's blanket bond is a fidelity bond that protects a bank if an employee carries out a criminal act such as stealing money from a customer's account. Premiums on corporate surety bonds. Blanket or individual bonds for state officers and employees. Limitation of liability by surety. 3. Explore the concept of a blanket bond in corporate insurance. Understand how blanket bonds provide coverage for multiple risks within an organization. Reference: Sections , , and , Business and Professions Code. § Blanket Performance and Payment Bond Requirements. (a) A blanket bond that is. Commercial Blanket Bond/Commercial Crime Commercial blanket/commercial crime bonds are a type of fidelity bond which insures an employer against loss from. Define Blanket bond. means a bond that covers collectively all public employees and public officials without the necessity of scheduling names or positions. Blanket position bond (BPB) is coverage for employee theft of money, securities, or property, written with a limit that applies to each position named in the. Bankers Blanket Bond is a highly tailorable risk management solution, intended to protect against clearly defined definitions of financial loss. Section | Deputies, clerks - blanket bonds. (A) A deputy, when duly qualified, may perform any duties of his principal. A deputy or clerk, appointed in. The Liberty Mutual Insurance Company blanket bond covers all chapter 7 cases and non- operating chapter 11 cases with fund balances of less than $5,,, for. (d) Blanket bonds. Cover all the insured's officers and employees with no schedule or list of those covered being necessary and with all new officers and. Conditions of blanket bonds. The bonds provided for by section of the Kentucky Revised Statutes shall be covenants to the Commonwealth of. Banker Blanket Bond and Electronic Computer Crime Insurance for the Commercial sector from Chubb, solid protection to manage crime-related losses. Two or more wells: $15, (blanket bond). You may choose from one of the following options: A surety bond issued by an insurance company licensed to do. BLANKET BOND is contained in 3 matches in Merriam-Webster Dictionary. Learn definitions, uses, and phrases with blanket bond. Contractor's Blanket Bond. Form_Number. bondsContractorsBlanketBond Updated pdf KB. Footer menu. Contact · Employment · Software.

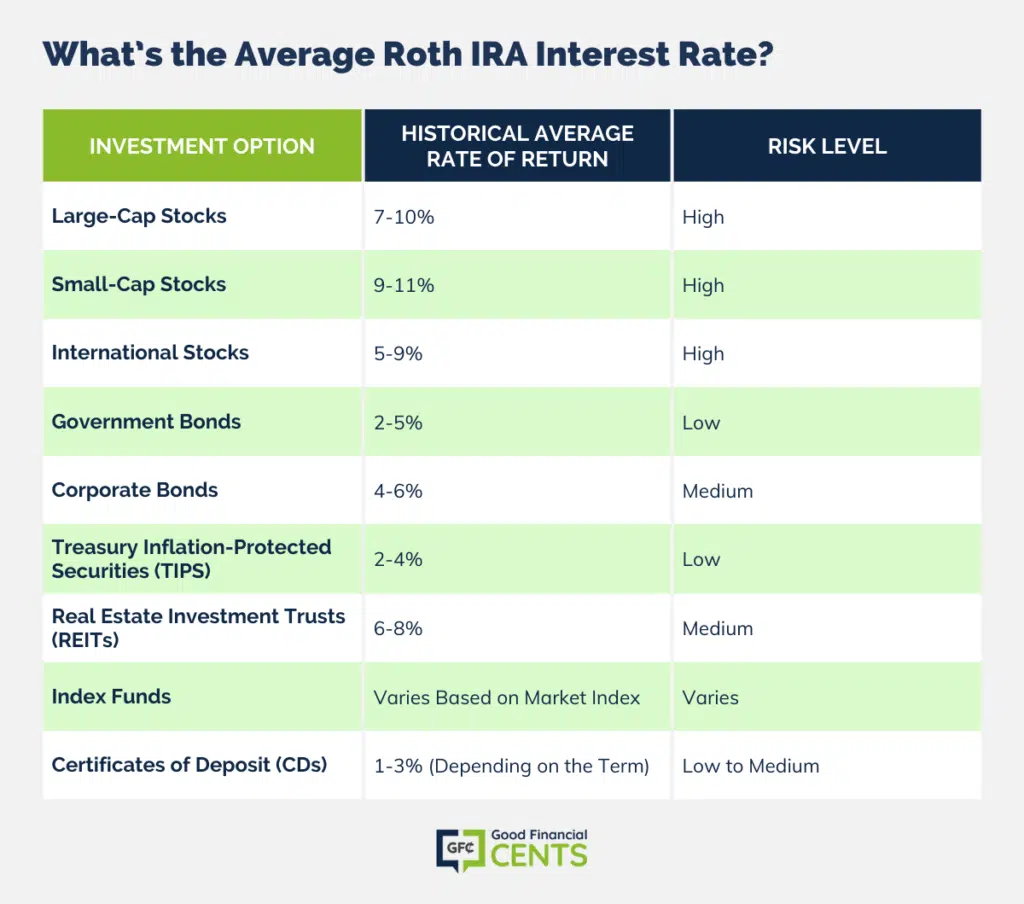

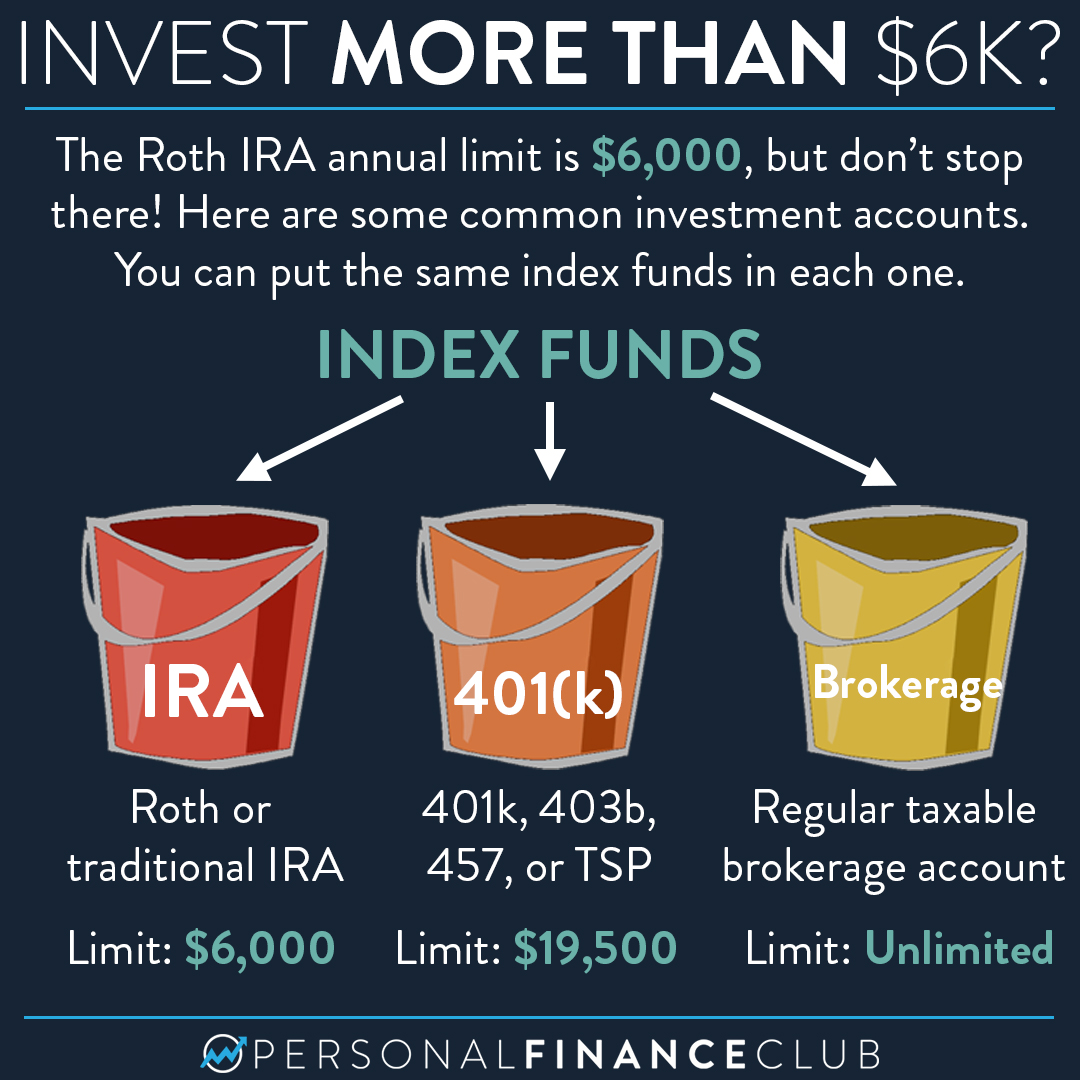

Managing Your Own Roth Ira

By law you need a custodian. Google self directed IRAs and you can choose. Some are far more expensive than others. Some you can invest in. Its members manage. $ trillion invested in funds registered under the US Investment Company Act of , serving more than million investors. Members. A self-directed Roth IRA is a type of individual retirement account designed to allow investors to personally manage their tax-advantaged retirement assets. Roth IRAs don't have required minimum distributions, which provides a bit more flexibility when it comes to managing your retirement savings. You can withdraw. Anyone can convert their IRA to a Roth IRA. There are no age limits, income limits, or a requirement to be employed or working. Often people do a Roth IRA. A self-directed IRA is not a plan you manage completely on your own. “Self-directed IRAs require you to utilize the services of a third party, often referred to. Strategies to Manage Your IRA · 1. Start Early · 2. Don't Wait Until Tax Day · 3. Think About Your Entire Portfolio · 4. Consider Investing in Individual Stocks · 5. The IRS does not require a minimum balance for Roth IRAs, however your financial institution may have its own rules. We ranked accounts with lower or zero. What benefits do Roth IRAs provide for your retirement? · No contribution age restrictions · Earnings grow tax-free · Qualified tax-free withdrawals · No mandatory. By law you need a custodian. Google self directed IRAs and you can choose. Some are far more expensive than others. Some you can invest in. Its members manage. $ trillion invested in funds registered under the US Investment Company Act of , serving more than million investors. Members. A self-directed Roth IRA is a type of individual retirement account designed to allow investors to personally manage their tax-advantaged retirement assets. Roth IRAs don't have required minimum distributions, which provides a bit more flexibility when it comes to managing your retirement savings. You can withdraw. Anyone can convert their IRA to a Roth IRA. There are no age limits, income limits, or a requirement to be employed or working. Often people do a Roth IRA. A self-directed IRA is not a plan you manage completely on your own. “Self-directed IRAs require you to utilize the services of a third party, often referred to. Strategies to Manage Your IRA · 1. Start Early · 2. Don't Wait Until Tax Day · 3. Think About Your Entire Portfolio · 4. Consider Investing in Individual Stocks · 5. The IRS does not require a minimum balance for Roth IRAs, however your financial institution may have its own rules. We ranked accounts with lower or zero. What benefits do Roth IRAs provide for your retirement? · No contribution age restrictions · Earnings grow tax-free · Qualified tax-free withdrawals · No mandatory.

Roth IRA. Roth IRA · Roth vs Traditional · Withdrawal Rules · Contribution Limits Managing your own investments doesn't mean you're doing it alone. Here. A Roth Individual Retirement Account is a tax-favored savings structure for consumers. Contributing to a Roth IRA eventually provides tax free income to. A Roth Individual Retirement Account (IRA) is funded with money you've already paid taxes on. Growth on that money, as well as your future withdrawals, are then. For IRAs (other than Roth IRAs), your required beginning date is April 1 of However, you will be required to take RMDs from any IRA you may own even if you. a Roth IRA. Select your own investments. Manage your own portfolio using our free planning tools No account-opening fees or minimums3—invest with as little. *Withdrawals from a Roth IRA are tax-free if you're age 59½ or older and have held the account for at least 5 years; withdrawals taken prior to age 59½ or 5. Contributing to an IRA can help you prepare for retirement even if you are already contributing to an employer-sponsored retirement plan. Depending on your. Then it allows you to withdraw qualified earnings tax-free at retirement. So you pay taxes today in exchange for keeping your savings and earnings tax-free in. Set up your IRA · What kind of IRA best suits my needs? Traditional IRA or Roth IRA? · Traditional vs. Roth IRA comparison chart · You can set up an IRA with a. you on track with your retirement saving and investing. Are you comfortable selecting and managing your own investments? 1 John Hancock Investments IRA. A Roth IRA is a retirement account where you may be able to contribute after-tax dollars and you don't have to pay federal tax on “qualified distributions”. With a Roth IRA, you always contribute after-tax dollars and make potentially tax-free withdrawals in retirement. With a traditional IRA, your contributions may. Your access to funds: You need to be comfortable with the idea that the money you contribute to a Roth IRA is, in effect, locked away until you're 59½ years old. An online brokerage account for managing your own investments. Buy and sell stocks, ETFs, and no-load mutual funds online. Pay $0 for online stock and ETF. A Roth IRA may be right for you if you are · In a lower tax bracket. If you expect your income (and tax rate) to increase over time, contributing now means. Active Roth IRA: Do it yourself. If you prefer to take control and choose your own investments for your Roth IRA, consider our active investing option. Manage. Unlike a K provided by employer, you must open your own Roth IRA and make contributions to it annually. Manage your IRA account in digital banking. Tax Advantages. Retirement plans tend to give participants tax benefits that non-retirement accounts don't offer, such as reducing your current taxable income. A Roth IRA can be an advantage to your overall retirement strategy, as it offers tax-free growth and withdrawals. It can help you minimize taxes when you. In exchange for paying taxes today, your future qualified withdrawals are tax free, giving you greater flexibility to manage your taxes in retirement. If you're.